The annual manufacturing report compiled from survey data in August and September 2016 and covers areas such as the economy, connectivity, automation and recruitment.

It comes as no surprise that uncertainty factors in a range of responses, especially when talking about the economy and in general. Whilst things have remained reasonably stable in the light of Brexit, it is clear that the unknowns of the next few years are having an impact on the decision making in many companies. For some this uncertainty is translating into delays in investment and commencement of new projects.

Despite more than 60% of respondents saying that European political uncertainty has had an adverse effect on their business, when asked how confident they were about the prospects for growth in the European economy over the next 12 months, there were very few who answered at extreme ends of the spectrum (very optimistic / very pessimistic). Most answers ranged in the middle of the spectrum with 34% stating they were neither optimistic or pessimistic. However, there is clearly an impact with many businesses stating they would prefer to fund developments in the short term future from their own cash reserves rather than risk further debt.

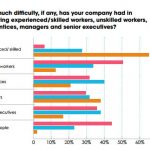

The second biggest factor giving manufacturers concern and being blamed for having an adverse impact on their business is the skills shortage. More than 60% of respondents said that they struggle to recruit skilled and experienced workers. And this carries on to management staff too with nearly 40% having trouble recruiting experienced management staff. When thinking about the staff of the future, perhaps a little disconcerting is the fact that 40% of those asked stated they have had some difficulty in recruiting apprentices. Clearly, there is work to do in this area if we are to maintain and grow the skilled manufacturing workforce of the future. Brexit and freedom of movement for labour will inevitably have an impact here too in the future.

Connectivity and automation is an area where companies have made progress. Many were already undertaking or planning to undertake improvements in connectivity with two thirds stating that they made investments into automation in the past 12 months. The top areas where connectivity improvements had been made were human / machine interface, sensors and alarms. The report indicates that manufacturers are increasingly seeing connectivity, not just as a means of reducing costs, but as a way of generating revenue by achieving higher production levels or by allowing them to enter new markets.

Whilst the majority of those asked (65%) stated they had invested in automation over the past 12 months, the response to the follow up question for those who had not invested was an indicator that more knowledge around automation is needed. Of the remaining 45% one of the biggest reasons given for not taking on more automation was that respondents didn’t know where to start.

Interestingly, despite the headlines that automation will take away jobs, reducing staff costs was not the major objective for many of the most recent automation projects completed. Improvements in production time, business efficiency and quality were the major objectives given for automation, closely followed by improvements in health and safety and the ability to free up staff for more ‘added value’ tasks. Less than 30% saw automation as a means of reducing staff costs.

Interestingly, despite the headlines that automation will take away jobs, reducing staff costs was not the major objective for many of the most recent automation projects completed. Improvements in production time, business efficiency and quality were the major objectives given for automation, closely followed by improvements in health and safety and the ability to free up staff for more ‘added value’ tasks. Less than 30% saw automation as a means of reducing staff costs.

With that start of Brexit negotiations looming on the horizon and the ever present worries about skills shortages the report, the report is a good insight into attitudes and perceptions across the industry. It will be interesting to see the changes in response over the next few years as we go through the turmoil of Brexit.

Click here to download the full Annual Manufacturing Report

Image: Samuel Zeller

This site uses Akismet to reduce spam. Learn how your comment data is processed.

Mail:

Mail:

Leave a Comments